Opening for Professional CA Firm as IND – AS Consultant for a period of one year

The scope of services for a period of 1 year would include the following works. The list below is indicative not exhaustive:

1. Assisting in Preparation of IND-AS compliant quarterly/half yearly/ yearly accounts (Standalone & Consolidated) falling during the tenure of contract.

2. Assisting in Preparation of IND-AS compliant financial statements and comment thereon including Notes to Accounts and its Audit from the Statutory Auditors and CAG auditors.

3. Assisting in Finalizing Ind AS accounting policies and procedures (Standalone & Consolidated) including Inputs & review of policies and statutory regulations.

4. Assisting in replying to the queries of the Office of Statutory Auditors and CAG during the audit of IND-AS compliant financial statements which are falling during the tenure of contract.

5. Assist in computation of matters relating to taxation required for the purpose of preparation of Ind AS complaint accounts as mentioned above, and matters incidental thereto arising from companies Act, 2013 or any other legislation.

6. Assisting in timely incorporation of any changes proposed in IND-AS by the Reserve Bank of India/ Ministry of Corporate Affairs/ National Housing Bank / Institute of Chartered Accountants of India / SEBI & Other Regulatory bodies and develop approach to address those changes, if applicable.

7. The consultant shall be required to be available for discussion on matters arising due to preparation of accounts as mentioned above, with the internal auditors/ statutory auditors/ Government auditors in case of difference of opinion or to clarify the position of the Company and effecting changes in system/ process, in case of need/ requirements.

8. The consultant will assist/help the other departments in Ind AS related computations and in developing reporting instructions and disclosure checklists.

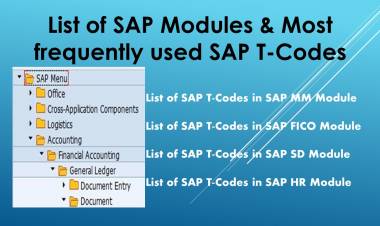

9. As ERP is under implementation in HUDCO the consultant shall help in identify changes to IT System and processes where required. The consultant will assist/provide inputs to HUDCO regarding changes required in the present accounting system for implementation of IND-AS to facilitate HUDCO’s IT department.

10. Session with Senior Management, Classroom base general trainings to the officials of HUDCO minimum four number of trainings (2 days of training each) on IND-AS covering overview of IND-AS, changes in the Ind AS including Page 8 of 16 latest developments and such aspects about Financial Statement preparation work in accordance with IND-AS. The number of trainings may increase on the basis of actual requirement.

11. The consultant will assist HUDCO with the presence of an assistant minimum for a day in a week and for minimum three days in a week during the preparation of quarterly/half yearly/ yearly financial statements as applicable. The presence of senior partner is also required for discussions and clarifications to management/auditors/ERP consultants etc. The number of days for the presence of the assistant may be counted on cumulative basis as the requirement may be more at the time of preparation of quarterly/half yearly/ yearly financial statements, as applicable, wherein the presence for more than three days may be required.

12. Any other services/assistance whatsoever required by HUDCO management relating to Ind-AS for preparation/finalization of financial statements.

TECHNICAL CRITERIA FOR SELECTION OF CA FIRM

Location of the organisation

1. The CA Firm should have its Head Office in Delhi or NCR.

Strength of the organisation

1. The CA Firm must have at least Five Partners as on the date of submission of tender, and the average annual turnover of the firm for the last three years should be ₹ 1 crores.

2. As on the date of tender, minimum paid CA staff strength of the firm should be 10 employees (excluding partners and articled assistants).

Post qualification experience of Partners

1. At least 3 Partners of the Firm should have an experience of practising as CA for more than 10 years.

2. CA Firm should have an experience of at-least five years in auditing/ consultancy out of the aforesaid five years’ experience in consultancy of Ind-AS should be for a period of 2 years in any 2 amongst Listed: PSU’s/ NBFC’s/HFC’s

For official document click here

Download APP

Download APP

P K Gupta

P K Gupta