Ind - AS 116 Leases

IND AS 116 Leases (applicable from 1.4.2019)

IND AS 116 is covering the accounting, disclosures, recognition, measurement and presentation related with Leases.

Ind AS 116 will replace current Ind AS 17 Leases.

IND AS 116 eliminates the accounting difference between an operating lease and an finance lease from the perspective of Lessee. Lessee’s with operating leases have to face a major impact.

Classification as Lease:

Under the new standard, a lease is a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration.

Below conditions need to be fulfilled if the contract is to be classified as lease:

- Identified asset.

- Lessee obtains substantially all of the economic benefits.

- Lessee directs the use.

Lessee Accounting:

Ind AS 116 recognise assets and liabilities for all leases with a term of more than 12 months (unless the underlying asset is of low value).

Lessees are required to initially recognize a lease liability for the obligation to make lease payments and a right-to-use asset for the right to use the underlying asset for the lease term. The lease liability is measured at the present value of the lease payments to be made over the lease term.

The right-to-use asset is initially measured at the amount of the lease liability and adjusted for lease prepayments, lease incentives received, the lessee’s initial direct costs and an estimate of the restoration, removal and dismantling costs.

Lessor Accounting:

Requirements with regard to lessor accounting are substantially similar to accounting requirements contained in Ind AS 17. Accordingly, a lessor will continue to classify its leases as operating leases or finance leases.

- Finance lease - if it transfers substantially all the risks and rewards. incidental to ownership of an underlying asset. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset. And derecognize the underlying asset and recognize a net investment in the lease.

- For operating leases- lessors continue to recognize the underlying asset.

Major Impacts:

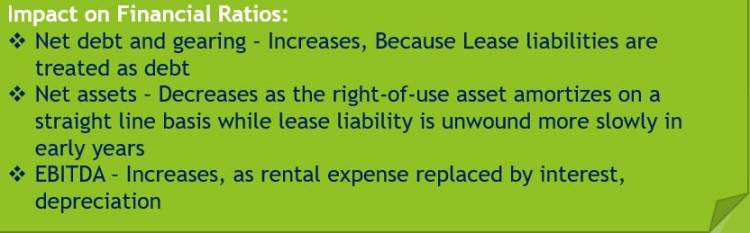

Impact on Financial Statements:

A lessee will recognise a right-of-use asset and a lease liability. Impact will be that it will recognise depreciation and interest expense in P&L, which earlier was recognised as lease rental.

Huge volatility in P & L will arise if foreign currency leases are there. Ind AS requires foreign currency lease liabilities to be retranslated at each reporting date and resulting gain or loss is typically recognised in P&L.

Practical applicability:

Now we will understand the practical use of IND AS 116:

Assume an asset is taken on lease for 4 years and for ease of calculation and understanding assume fixed monthly lease rental of Rs. 2 lakh without any annual increment. So per year lease rental is Rs. 24 lakhs and total Lease Rental for 4 years is Rs. 96 Lakh. And Assume discounting rate @8%.

Now Present value of each year is calculated as follows:

Year PV Factor Actual Rental Present Value

Year 1 0.926 24,00,000 22,22,222

Year 2 0.857 24,00,000 20,57,613

Year 3 0.794 24,00,000 19,05,197

Year 4 0.735 24,00,000 17,64,072

Total 96,00,000 79,49,104

SO, Present Value of total lease rental 79,49,104

Total no. of months pending for lease 48

Quarterly Depreciation = 7949104/48*3 = 4,96,819

Quarterly Interest = 7949104x8%/12x3 = 1,58,982

Quarterly Rent = 200000x3 = 6,00,000

So net Quarterly impact will be accounted as follows:

Right-to-Use Asset Dr. 79,49,104

To Lease Liabilities Cr. 79,49,104

Depreciation Dr. 4,96,819

To Right-to-Use Asset Cr. 4,96,819

Interest Dr. 1,58,982

To Lease Liabilities Cr. 1,58,982

Lease Liabilities Dr. 6,00,000

To Rent Cr. 6,00,000

Download APP

Download APP