E- Invoicing in GST from 01st January 2020 (now postponed )

E- Invoicing in GST from 01st January 2020 (now postponed)

1.What is proposed e- Invoicing in GST? All the invoices will now be prepared on line only?

2. Do I need to issue e-invoice for every transaction?

3. I am not using any software for billing; do I need to invest on new software for e-invoicing?

4. What is timeline of implementation of e-invoicing system for GST?

5. e-invoicing system is applicable for all the documents related with GST of only for Invoice?

7. What is the maximum number of line items supported by e-invoice?

8. Will there be any column / space to show currency in e-invoice?

9. e-invoice generated through IRP is required to be signed by the taxpayer or not?

10. Bulk uploading of invoices is allowed for generation of e-invoices?

1.What is proposed e- Invoicing in GST? All the invoices will now be prepared on line only?

In the proposed e-invoicing system of GST the tax payer after preparing invoice in his software / ERP shall generate Invoice Reference Number (IRN) & Quick Reference code (QR) from Invoice Registration Portal (IRP) and shall issue invoice with this IRN and QR code.

This is a misconception in the taxpayer that invoice will be prepared online. Invoice is to prepared as usual but you need to generate IRN & QR from IRP.

2. Do I need to issue e-invoice for every transaction?

No, at start e-invoicing is required for all B2B / B2G transactions (which are covered for any taxpayer as per implementation schedule) and all exports transactions. And Not applicable for B2C transactions.

3. I am not using any software for billing; do I need to invest on new software for e-invoicing?

No, You need not to invest for new software for e-invoicing. GSTN has provided 8 free e-invoicing software for taxpayers having turnover up to Rs. 1.50 crore.

4. What is timeline of implementation of e-invoicing system for GST?

e-invoicing for GST shall be implemented in phased manner:

- From 01st January 2020 – Optional for Taxpayers whose aggregate turnover is more than Rs. 500 crore

- From 01st February 2020 – Optional for Taxpayers whose aggregate turnover is more than Rs. 100 crore

- From 01st April 2020 – Madatory for Taxpayers whose aggregate turnover is more than Rs. 100 crore

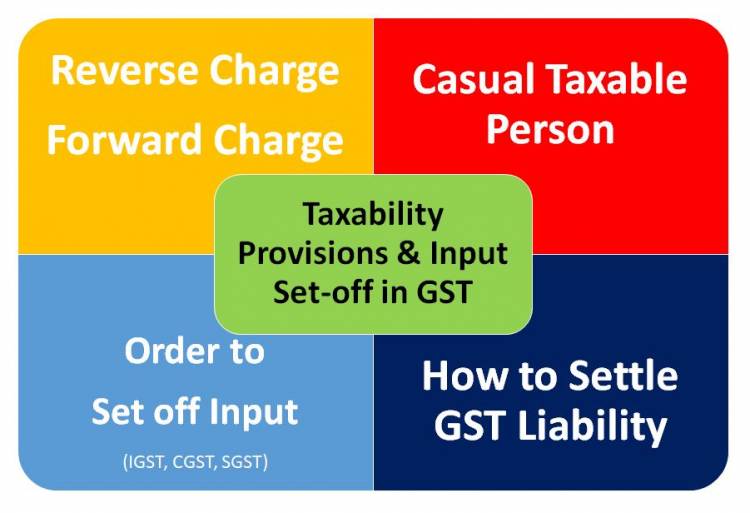

5. e-invoicing system is applicable for all the documents related with GST of only for Invoice?

If as per implementation schedule of e-invoicing you are covered then following documents are required to be processed as per e-invoicing system:

- Invoice

- Debit Note

- Credit Note

- Other specified documents

But not required for following documents:

- Bill of Supply

- Job Work / Delivery Challan

6. What will the process of e-invoicing? Do I need to type/write IRN (invoice Reference Number) generated from IRP (Invoice Registration Portal)?

No need to type/write anything on existing invoice, everything is system / software driven. The following process is to be followed:

Step 1

Prepare Invoice as usual.

Step 2

Generate JSON file of Invoice

Step 3

Submit JSON file to IRP (Invoice Registration Portal)

These three steps are to be done by taxpayer and rest of the steps shall be done by software itself.

Step 4

IRN shall generate the Hash no. (an unique no. of 64 digit by using supplier GST no., FY, Document no. etc.) and QR code (which is similar to bar code)

Step 5

GST System shall store this hash detail in its system. And will update ANX-1 of Seller and ANX-2 of Buyer.

Step 6

Seller will receive JSON file having digitally signed invoice and digitally signed QR code. And can see the Invoice and GST liability in his ANX-1

Step 7

Buyer can receive registered invoice form IRP (Invoice Registration Portal) and can use QR code to verify the authenticity of invoice.

And buyer can also view the detail of ITC related to this invoice in his ANX-2.

7. What is the maximum number of line items supported by e-invoice?

Maximum number of line items supported by e-invoice system is 10000 per invoice.

8. Will there be any column / space to show currency in e-invoice?

Yes, there will be column to display currency by default it will be INR.

9. e-invoice generated through IRP is required to be signed by the taxpayer or not?

It is not mandatory to sign the e-invoice. e-invoice will be digitally signed by IRP after validation. And once it is registered then there is no any need of any more signs by anyone.

10. Bulk uploading of invoices is allowed for generation of e-invoices?

Bulk uploading is not allowed. Invoices are to be uploaded on one to one basis.

11. As e-invoice is now linked to GST portal and ANX-1 and ANX-2 and E-way bill will be auto updated / generated, now carrying e-way bill in transit is required or not?

At present there is no any change is done in eway bill carrying rules for transit. So eway bill will be required even after generation of e-invoice.

12. Can IRP (Invoice Registration Portal) reject the invoice (JSON File) submitted for generation of e-invoice?

Yes, IRP can reject after validation. IRP validate the file by checking GSTIN and by checking existence of duplicate invoice for the same invoice.

If validation failed then error code will be sent.

13. Is there any requirement of signing of JSON file before submitting it to IRP (Invoice Registration Portal)?

It is optional.

14. When taxpayer submits Invoice JSON file to IRP (Invoice Registration Portal) for generation of e-invoice then IRP will return the signed JSON file or PDF file or both?

IRP will return signed JSON file and no PDF will be returned. There will be digital signature of IRP.

15. Invoice uploaded on IRP can be amended? If yes, how will amendments of invoice data uploaded on IRP (Invoice Registration Portal) can be done?

e-invoice once uploaded can be amended at GST portal only and IRP can not do any amendment.

But, if taxpayer wants to cancel already uploaded invoice, then he can do the same by uploading the following details at IRP:

- GSTIN

- Type of Document

- Document no.

- Document date

Note: Once cancelled invoice number can not be used again to generate another invoice.

Download APP

Download APP

P K Gupta

P K Gupta