“Most awaited and must required Gift by Indian Government to Companies”

“Most awaited and must required Gift by Indian Government to Companies”

On 20th September 2019, tax concessions were announced by Indian Finance Minister, Nirmala Sitharaman with an intention to boost the economy and to promote ‘Make-in-India’ applicable W.E.F FY 2019-20.

Highlights of Tax Concession:

- Corporate Tax slashed for domestic companies:

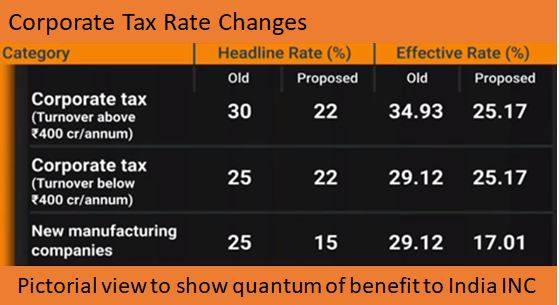

After 1st October 2019, the corporate tax rate brought down to 22% from 30%, effective corporate tax rate after surcharge to be 25.17%. The reduction of taxation has been a long-standing demand. In comparison with peer countries like China and rest of the world, India was always pin pointed for higher taxation. Government is hopeful that by decreasing tax we will benefit from America China trade war and more companies will come to India and revive the economy.

- Lower Income Tax for New Manufacturing Companies:

Companies set up post October1, 2019 shall pay effective tax of 17.01% brought down from 25% to 15%. Companies who start manufacturing before 31st March 2023 will be subjected to lower income tax rate.

Major tax in India comes from auto sectors and reduction in taxation will benefit the most as there will be direct effect on profits of the companies. This move is seen to be taken for controlling the slowdown in automobile sectors as we have recently seen that automobile companies are firing people due to sales and profit going down. This is a Massive incentive for small manufacturing enterprises (SME’S) to set up more manufacturing units. Micro Small and Medium Enterprises (MSME’s) are the lifeline of Indian economy and government is hopeful to see major involvement from them after the tax deduction.

- Direct Tax reforms:

Companies which avail tax exemption shall be liable to pay tax at the pre-amended rate but these companies can opt for concessional tax regime after exemption period. After exercising the option, they shall be liable to pay at the rate of 22% and once the option is exercised it cannot be withdrawn. In order to provide relief to companies who avail tax exemptions the of Minimum Alternate Tax has been reduced from 18.5% to 15%. Reduction in MAT rates is good for specially those companies that enjoy tax holidays but pay income tax under MAT provisions. Theoretically, MAT credit can be carried forward and utilised in future periods, but it impacts the investment decisions which are usually taken after considering present value of money. After reduction of MAT and corporate tax, the deferred tax liability will also reduce which will reduce burden of taxation and corporate would be left with more spending power in their hands but even MAT is a huge concern for companies present into special economic zones (Sez’s) and have tax holidays. These companies are currently paying MAT at 22% effective rate and accumulates the credit to set off when tax holiday ends but now if they choose to move to the new tax regime and lower MAT rate, then they may end up losing out on the accumulated credits which is a major loss for the companies in red and these companies will have to write off deferred tax assets which was booked previously related to their loss if they want to opt for 22% tax regime.

- Foreign portfolio investors:

Government has decided to pull back the surcharge on capital gains by foreign portfolio investors. This step has demonstrated the world that India should remain preferred hotspot and preferred investment destination as far as foreign investments are concerned and it has opened gates for increased foreign supply in the market which would help the market to revive and would see more inflows of foreign investors, which had been reduced in first quarter.

- Expands scope of CSR spending:

According to the companies act, firms with net worth of ₹500 crore or more, or turnover of ₹1,000 crore or more or net profit of ₹5 crore or more, are required to spend 2% of average net profit of the preceding three years on corporate social responsibility (CSR) activities and till now companies were permitted to provide CSR funds to Till now, companies were allowed to provide CSR funds to technology incubators located within Centre-approved academic institutions but now government has expanded the scope for CSR funds and it could be be spent on incubators funded by the Centre or state or any state-owned companies. This step will attract more funds on research and development in the country and bring notable changes and reforms in development of country.

These were the highlights of tax concession. Let us now see how will it affect the economy.

Loss to Government:

Government will have loss of “1.5 lac crore” due to this decrease in tax and to tackle this government has already taken 1.76 lac crore from RBI”.

Loss of revenue for government but will not only boost the Indian domestic companies but will also attract foreign direct investments and new companies that are wanting to set up manufacturing unit in India.

Profit to shareholders and employees:

Lower taxes will improve the cash flow and profitability of corporate companies and it will be able to distribute a part of it as dividends to shareholders or retain their profits and provide room for higher investments which will boost demand in the economy. Employees working for the companies will benefit in orm of higher increments and incentives.

Reduction in Unemployment:

We have seen a major rise in unemployment. This step of government will increase job opportunities and corporates will be able to follow their ideas and implement them with the help of surplus cash available to them.

Increase in consumption:

Companies are now able to save taxation which will help them to provide products at the discounted rate this will help in higher sales and higher consumption which will have direct effect on GDP.

Although the move will cost the government ₹1.45 lakh crore in the current fiscal year in terms of lost revenue but it has witnessed the biggest rise in the decade of Indian history as the Sensex settled 1921.15 points higher that is (5.32%) on the same day of announcement.

Sectors benefitting from the rate cuts:

Banking, Auto and FMCG sectors contributed majorly in the growth of Sensex. The auto sector rallied 13%, bank index rose 5.5% followed by FMCG index at 4.4%

Mid-caps and small caps also participated in the rally by contributing 3% each.

IT stocks saw some strong profit-taking after cut in corporate tax rate to 22% as it will be negligible for IT companies in the current fiscal due to tax exemptions on revenues from special economic zones (SEZs).

Automobiles, banks, capital goods, consumer staples, diversified financials and oil, gas and consumable fuels will be key beneficiaries of the sharp cut in corporate tax rate while electric utilities, IT and pharmaceuticals will see little or no impact, Kotak Institutional Equities said.

surcharge shall not apply to capital gains on sale of equity share which is subject to STT (Securities Transactions Tax) would go a big way in restoring confidence in the Indian equity markets.

The bold decision and risk taken by Government through this step should surely increase our GDP as it was 5% in first quarter lowest in 6 years.

Keeping fingers crossed we are waiting to see the upliftment of economy.

Download APP

Download APP