TCS on sale of Goods - newly inserted section 206 C(1H) in Income Tax

TCS on sale of Goods

Amendment in Finance Act 2020 amended provisions relating to TCS with effect from 01st Oct. 2020. New Section 206C (1H) is inserted.

Every seller of goods who meets out the below conditions shall collect TCS @0.1% (.o75% till 31 march 2021) :

Conditions:

1. Turnover during the financial year immediately preceding the financial year in which the sale of goods is made is more than Rs. 1o crore.

2. Sale of goods of the value exceeding Rs. 50 lakh from a single buyer.

3. TDS provisions are not applicable to this sale.

Exceptions:

a) Sales made up to 30th September shall not be counted for the purpose of collection of TCS.

b) TCS is to be collected not at the time of sale but at the time of receipt of sales proceeds.

c) TCS provisions of section 206C (1H) are not applicable to export sales.

d) TCS provisions of section 206C (1H) are not applicable to the sales made to Central / State Govt. , Embassy, Local Authority (defined u/s 10(20), A high commission or trade representation of foreign trade.

e) Goods covered u/s 206 C(1) like Tendu leaves, Timber, Scrap, mineral etc. are not covered u/s 206C (1H).

f) Goods covered u/s 206 C(1F) like motor vehicle exceeding Rs. 10 lakh etc. are not covered u/s 206C (1H).

g) Sum of money above Rs. 7 lakh for remittance out of India and seller of an oversea tour program package (u/s 206C(1G)) are not covered u/s 206C (1H).

Important points:

A. If the buyer is not giving PAN then the seller shall collect TCS @1% instead of 0.1%

B. TCS collected by the seller shall be deposited to the Govt. account on or before the 7th of next month.

Clarifications:

1. No TCS to be collected on collection done prior to 01st Oct. 2020

2. Only Receipts after 01st Oct. 2020 is liable for TCS collection

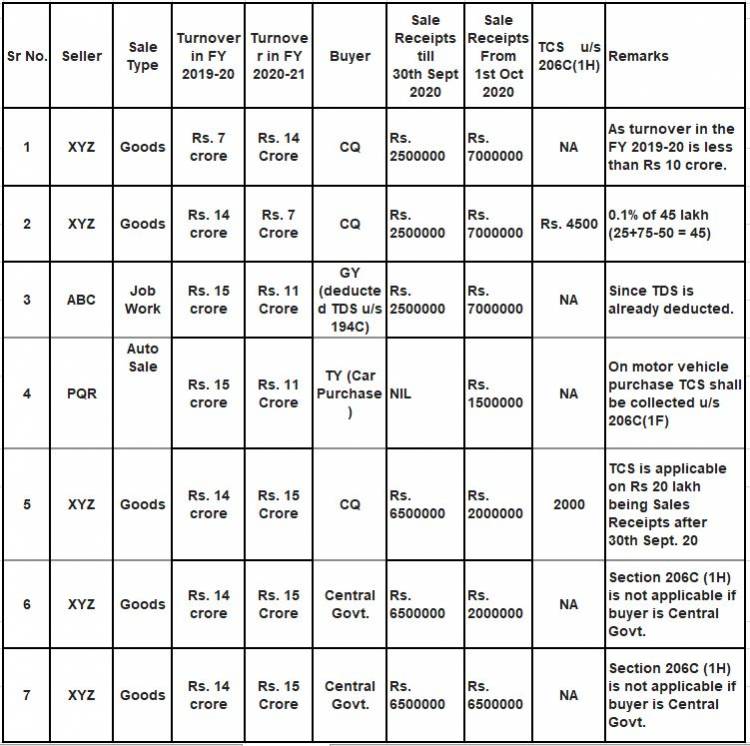

The below table is illustrative to clarify the applicability of the provision in various situations:

The TCS collected by the seller is not an additional tax levied by Govt. but just like an advance tax. So the buyer can take credit of that while filing income tax return.

Don't forget to grab a copy of "Job-Career Journey" the amazing book which guides about how to be #successful in your job-career and how to transform from an #EMPLOYEE to an #ENTREPRENEUR.

Click on the below link to grab the copy of the book:

Download APP

Download APP

P K Gupta

P K Gupta