Step by Step procedure to Add Challan in TDS Statement at Traces Online

In the following situations we need to add online challan to our already filed statement: -

- We miss few challans & deductee details in a statement

- Interest liability arises on a statement after the filing of the statement

- Late filing fee or any other penalty arises after the filing of the statement

Following are the steps to add challan online through traces: -

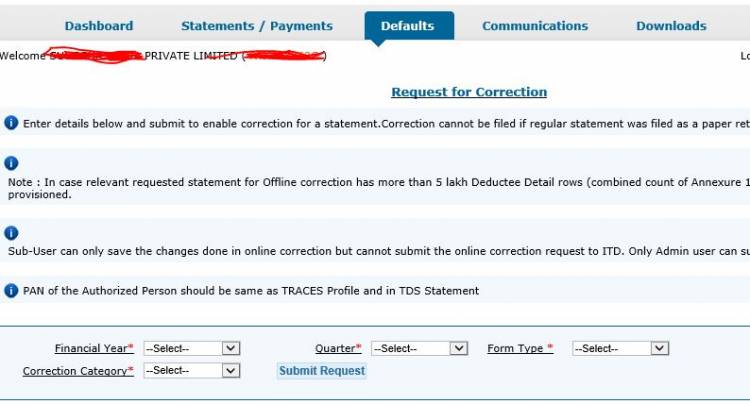

1. After login to traces, click on default tab & in that click on Request for Correction.

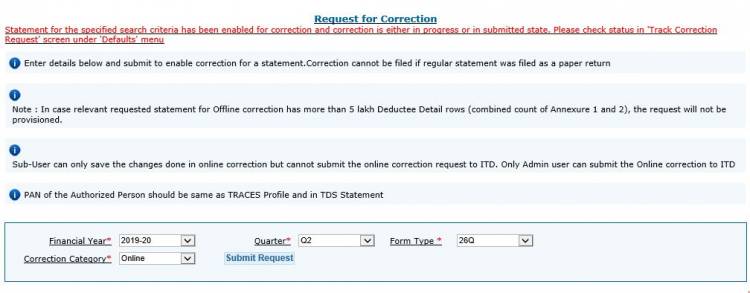

2. After clicking on request for correction, a window will open which will ask the financial year, quarter, form type & correction category.

Fill up financial year & quarter (Q1/ Q2/ Q3/ Q4), & choose form type out of below: -

-

24Q – For Salaried

-

26Q – Other than Salaried

-

27Q – Non-Resident

In form type, choose online out of offline/ online.

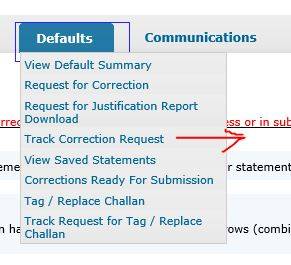

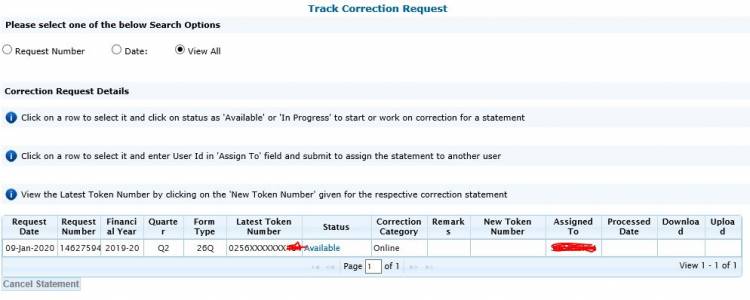

3. Once you have submitted, Request for Correction, then again click on the default tab & click on Track Correction Request. You can track a correction request by request no. or date or else click on view all to view all requests.

4. Then the list of correction requests will appear, in which status will reflect whether it is in processing or pending or available. We can process further only if the status of our required correction request is coming as Available. Then click on the required request once the status shows as available.

5. After clicking on request, it will take us to the authentication window, wherein we can choose DSC based KYC or Non -DSC based KYC.

DSC Based KYC for TDS correction on Traces: - We can opt for DSC Based KYC in Traces only if we have registered our DSC in our TDS Login profile. If we are already registered DSC in our profile, we can plug in the DSC to our system & can choose DSC based KYC to further proceed the add challan transaction.

DSC Based KYC is compulsory if we also want to add deductee details along with add challan. Otherwise, we can add challan with normal KYC at Traces but for adding deductee need to download updated consol file of already filed TDS statement & then again redeposit it with the utilization of newly added challan.

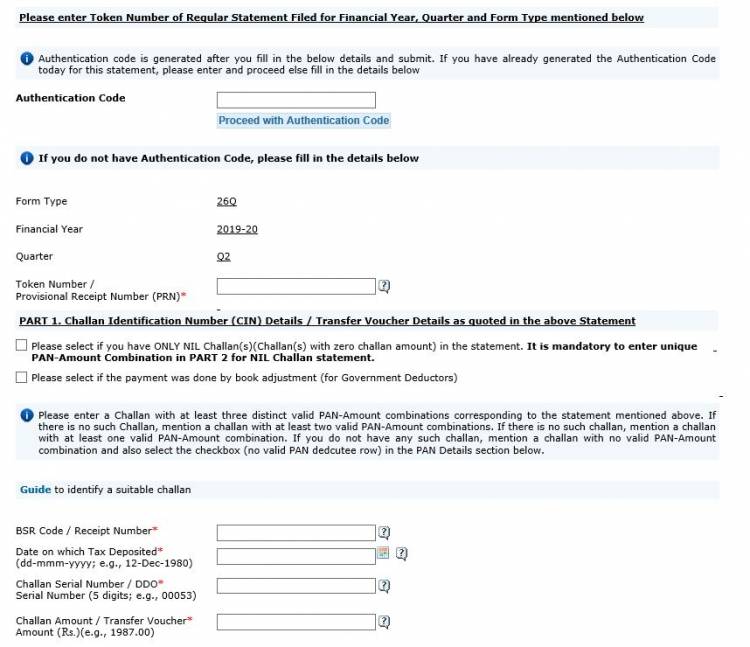

In any other case, we can choose for normal KYC at Traces. For normal KYC at Traces, we need to input the following details: -

-

Token No. or Provisional Receipt No. of the statement for which we are doing the correction.

-

BSR Code, Date & Challan Serial No. of anyone challan shown in that statement.

-

Any 3 Deductee’s PAN No. & Amount shown as utilization of above challan. Less than 3 deductee’s details are acceptable if the challan has total deductee less than

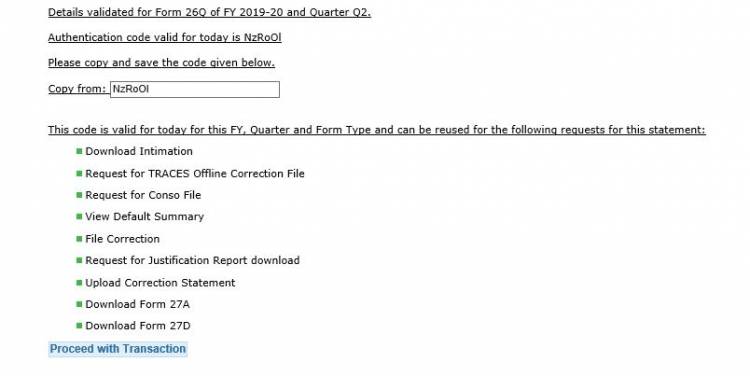

If the above details accurately match with the filed records, an authentication code will generate, that code will be valid for a day. So, if we need the same process or any other online TDS Correction at Traces again during the day, we need not put all the details to generate the authentication code. The same code can be inserted in the window for authentication.

6. After authentication, it will ask for a type of correction, wherein we need to choose to add challan to the statement. The option add deductee details will show only if we are proceeding through DSC based KYC.

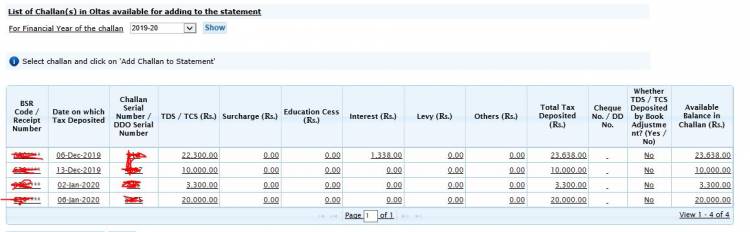

7. After that a list of unutilized challans will appear, it will show details of challans along with the date, BSR Code, challan serial no., amount bifurcation as TDS, Interest, Penalty etc. Also in case, we have partly used a challan, it will show us the balance amount available in challan which can be utilized.

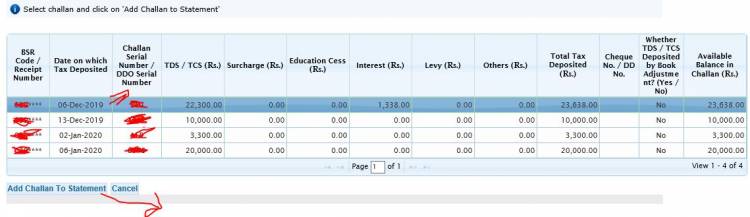

8. Then select the challan which we want to add to that statement, once we select it, it will highlight in blue colour. After selecting the challan click on Add challan to the statement.

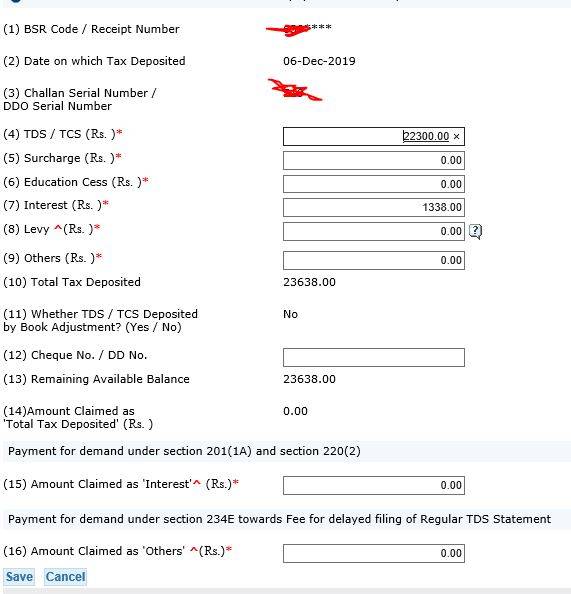

9. Then the challan breakup will open, wherein we need to again fill the column no. 15 or 16 again if challan consists of interest (column no. 15) and another amount (column no.16). Once we fill up the detail, save the challan.

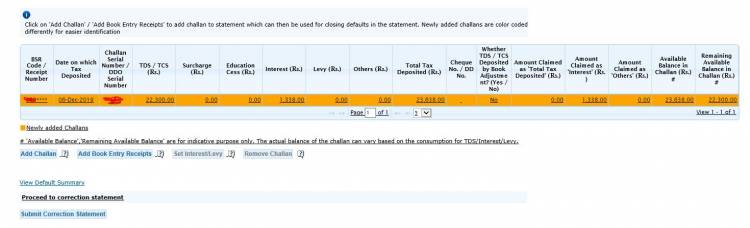

10. After saving the challan, this challan will appear in a new window with a colored line. Then click on submit correction request. If we are logged in with DSC KYC, at this stage in the type of correction, additional add/ modify deductee details will show, so instead of pressing submit correction request, if we want to add deductee details to newly added challan, we can select add/ modify deductee and click on proceed.

11. Then the correction request for add challan will be submitted and a tracking ID will generate.

12. Generally, after 24 hours, the newly added challan will reflect in the statement.

Download APP

Download APP

Rukmani Gupta

Rukmani Gupta