Author: Rukmani Gupta

Bharti Airtel is a Buy or Sell?

Airtel is wan in Red today because it has paid Rs. 10000 cr. to DoT as part of its...

Be Aware About Tax on Your EPF Contribution & EPF Withdrawal

EPF (Employee Provident Fund) has four components: - 1. Employee’s Contribution...

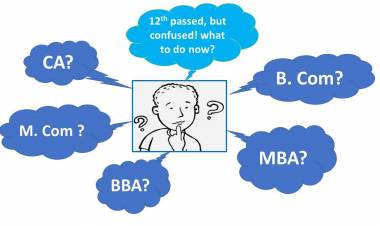

What are the career options in commerce after 12th?

1. B. Com (Graduation) -Accountants or Tax Consultants 2. M.Com (Post Graduation)...

Latest Vacancies for CA CS CMA MBA Bcom

CA Jobs, CS Jobs, CMA Jobs, Jobs for MBA, Jobs for Accountants

Step by Step procedure to Add Challan in TDS Statement...

1. After login to traces, click on default tab & in that click on Request for Correction....

Key Checks for a strong accounts & finance department in...

1. Choosing the right ERP 2. Choosing the right Manpower 3. Choosing the right flow...

Don't get into the lure of Career Prestige, Be creative.

As of today there is the clear trap of career prestige ahead, if you had chosen...

Difference & Similarities in Section 54 & Section 54F in...

Section 54 & Section 54F of Income tax Act

Capital Gain on Agricultural Land

1. what is Capital Gain? 2. what is Capital Asset ? 3. Type of Capital assets? 3....

Capital Gain on Gift, Will or Inheritance

1. Capital gain in case we receive any asset way of inheritance / will/ gift? 2....

Capital Gain Exemption u/s 54, 54F & 54EC

1. Conditions to get the exemption ? 2. How to Compute Exemption?

Cost Inflation Index (CII) in Capital Gain

1. What is Capital Inflation Index ? 2. How to calculate Indexed Cost of Acquisition?...

Capital Gain Deposit Scheme Account

1. What is Capital Gain Deposit Scheme 2. How I can close this Capital Gain Account...

GST Returns - Type, Due dates, Revision

Type of Returns, Due dates of GST Returns, Revising GST Returns

Download APP

Download APP