Blocked ITC on purchase of Motor Vehicles, Vessels, Aircrafts etc., on Membership of Clubs etc.

Blocked ITC on purchase of Motor Vehicles, Vessels, Aircrafts etc., on Membership of Clubs etc.

Continuing our discussion on the point that Sec. 17 of the CGST Act, 2017 restricts the availability of ITC on certain transactions, we will talk about Clause (a), (aa) and (ab) of Sec. 17(5).

|

Clause of Sec. 17(5) |

Restricts ITC on |

|

(a) |

Purchase of Motor Vehicles |

|

(aa) |

Purchase of Vessels/Aircrafts |

|

(b) |

Services related to Motor Vehicles, Vessels etc. |

Sec. 17(5)(a) : ITC not allowed when Motor vehicles are purchased - ??

|

(1) |

(2) |

(3) |

(4) |

|

ITC Not Allowed |

For Example |

ITC Allowed |

For Example |

|

1. Motor Vehicle purchased with a sitting capacity of less than 13 persons. |

A business man purchases an Audi car with sitting capacity of 6. In that case No ITC shall be allowed. |

1. Motor Vehicle Purchased to further supply such vehicles. (Irrespective of sitting capacity). |

Car Dealers buy motor vehicles to sell them in the market. |

|

|

|

2. Motor Vehicle Purchased for transportation of passengers. (irrespective of sitting capacity) |

A person buys a motor car to run that on a particular route to transport passengers. |

|

|

|

3. Motor Vehicle Purchased for imparting training on how to drive motor vehicles. (irrespective of sitting capacity) |

A person buys a car and opens a car driving training school. |

Sec. 17(5) (aa): ITC not allowed when Vessels/Aircrafts are purchased - ??

|

(1) |

(2) |

(3) |

(4) |

|

ITC Not Allowed |

For Example |

ITC Allowed |

For Example |

|

1.Vessels or Aircrafts purchased even for business purposes |

A business man purchases an Aircraft to commute for business purposes. No ITC shall be allowed. |

1. Vessel/Aircraft purchased to supply them in the market. |

- |

|

|

|

2. Vessel/Aircraft purchased to train people. |

A person trains others on navigating vessels or a person trains others how to fly an aircraft. |

|

|

|

3. Vessel/aircraft purchased to transport passengers. |

- |

|

|

|

4. Vessel/aircraft purchased to transport goods. |

- |

Sec. 17(5) (ab): ITC not allowed when certain services availed related to (a) or (aa) above - ??

When a person runs/carries motor vehicles, aircrafts, vessels etc. there are certain chances that such articles/things need maintenance, protection from damages etc. To facilitate this services like Insurance, Repair and Maintenance etc. have been availed by a taxable person. Now clause (ab) of Sec. 17(5) prohibits availability of ITC paid on these services.

We shall refer the tables above and understand that:

|

Servicing, General Insurance, Repair & Maintenance etc. relates to |

ITC Allowed?? |

|

Column (1) of the above tables |

NOT ALLOWED |

|

Column (3) of the above tables |

ALLOWED |

|

A taxable person who is a manufacturer of motor vehicles, vessels, aircrafts |

ALLOWED |

|

Who is the supplier of services of general insurance in respect of such motor vehicles, vessels or aircrafts |

ALLOWED |

With the above to the point discussion we can understand how to explain a person whenever point of treatment of ITC on purchasing vehicles, motor cars etc. arises.

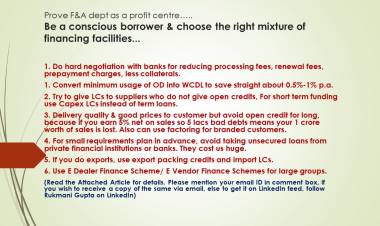

There are other provisions which do not allow a taxable person to take ITC. These are relevant because a business man incurs various sorts of expenses. ITC on each and every such expense is not allowed to be claimed under this law. Such cases/expenses are specified here:

Sec. 17(5)(b)(i) : ITC on Expenses related to Food/Beverages, beauty treatment etc.

|

Expense/Inward Supply |

ITC Not Allowed |

ITC Allowed |

|

Food, Beverage, Outdoor Catering |

A business man organises a party for his employees and avails catering service or incurs expenses on Food/Beverages etc. A business man distributes sweets on Diwali to his staffs, clients, relatives etc. |

When Inward supply of such goods/services is used for making outward supply of same category of goods/services which may be as composite or mixed supply e.g. a person buys chips, samosa, sweets, packaged water and make a bundle putting each such item or sells them individually, in that case ITC shall be allowed to him. |

|

Beauty treatment, health services, cosmetic and plastic surgery |

A business man organises to let his employees get groomed by using various beauty and cosmetic treatments. No ITC shall be allowed to him. |

When Inward supply of such goods/services is used for making outward supply of same category of goods/services which may be as composite or mixed supply e.g. a person selling cosmetic or beauty products can avail ITC. |

|

Leasing, renting or hiring of Motor Vehicles, vessels or aircrafts referred to in 17(5) (a)/ (aa). |

A person hires cab, takes cab on rent for his business use. No ITC shall be allowed. |

When Inward supply of such goods/services is used for making outward supply of same category of goods/services which may be as composite or mixed supply E.g. a person carries on a business of renting motor vehicles on hire and make supply by giving those motor vehicle on hire. Such a person can avail ITC. |

Sec. 17(5) (b) (ii) & (iii): ITC on Membership fees of clubs etc., travel benefits to employees

|

Expense/Inward Supply |

ITC Not Allowed |

ITC Allowed |

|

Membership of a Club, Health and Fitness Centre |

A business man subscribes for membership of a club which helps him to socialise and promote his business. No ITC shall be allowed in such a case. A person makes arrangement for gym facility for his employees, NO ITC shall be allowed to him. |

When it is obligatory for an employer to provide these facilities to his employees under any law for the time being in force. |

|

Travel benefits extended to employees on vacation |

In general cases not allowed. |

When it is obligatory for an employer to provide these facilities to his employees under any law for the time being in force. |

Other relevant cases when NO ITC shall be allowed:

17(5) (e): When a person pays any GST under composition scheme as per Sec. 10 of the CGST Act, 2017, he shall not be able to avail that as ITC.

17(5) (f): When a Non Residential Taxable Person avails any Inward Supply, no ITC shall be allowed to avail. In case, goods imported by him, credit of IGST paid on such imports shall be available to that person.

As per Sec.2 (77) “Non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India.

17(5) (g): Goods/Services used for personal consumption. It is obvious thing that expenses made in business account but consumed for personal use or other than business purpose, ITC on such expenses shall not be allowed at all.

17(5) (h): Goods Lost, stolen, destroyed, written off, or disposed of by way gift or free sample. Let’s understand these points one by one:

- Goods Lost/stolen: A person purchases certain goods. Few of them lost due to any human error or were stolen on the way. In purchase invoice, ITC is on all goods, but the taxable person has to take ITC excluding proportionate ITC on lost/stolen goods.

- Gifts/Sample: A person buys goods for his business purpose and distributes few of them as gifts of Diwali to his staff members or sends them as sample to his prospect clients free of cost. In this case, proportionate ITC on the value of Gifts/Sample shall be reversed as per sec. 17.

Download APP

Download APP