Author: P K Gupta

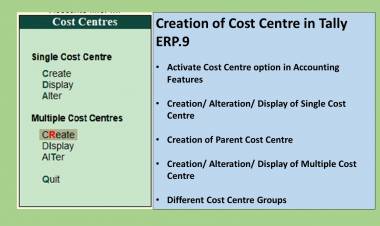

Creation of Single & Multiple Cost Centres in Tally ERP.9...

1. Activate Cost Centre option in Accounting Features 2. Creation/ Alteration/ Display...

Tax on Gift of Movable Assets

1. When a Gift of movable asset is chargeable to tax? 2. What is value of taxable...

Tax on Gift of Immovable Properties- Applicability & Exemptions

1. When a Gift of immovable property is chargeable to tax? 2. What is value of taxable...

Tax on Monetary Gifts – Applicability & Exemptions

1. Which “Monetary Gifts” are chargeable to tax. 2. Who can make monetary gifts...

GIFT Tax Applicability & Rate of Tax

1. Is Gift Tax abolished in India? 2. At what rate gifts are chargeable to tax?...

Articleship Training ICAI Norms & Guidelines Summary

ICAI broad Rules & regulations governing Articleship Training

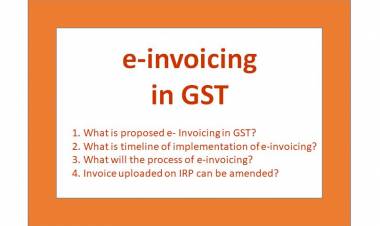

E- Invoicing in GST from 01st January 2020 (now postponed...

1. What is proposed e- Invoicing in GST? 2. What is timeline of implementation of...

Get Matches within your Professionals Community.

Just Few step away to find your dream soulmate Register for free Www.wedspairpro.com

Blocking of eway bill (EWB) generation facility at EWB...

1. What is Blocking of eway bill? 2. How it will be unblocked? 3. what will the...

Director in Company

1. Meaning of Director 2. Types of Director 3. Minimum required Director 4. Qualification...

Capital Gain on Equity Shares & Mutual Funds

1. What is section 111A in capital gain ? 2. What are the equity oriented mutual...

Role of Stamp Duty in Full Value of Consideration in Capital...

Is registration date or agreement date is relevant for comparing stamp duty value...

Long Term Capital Gain

1. Meaning of long term assets 2. Benefits of assets being long term 3. Calculation...

Active e-form (INC - 22A) at MCA

1. Applicability of ACTIVE e-form 2. Restrictions on filing the ACTIVE e-form 3....

Download APP

Download APP