Posts

GST Returns - Type, Due dates, Revision

Type of Returns, Due dates of GST Returns, Revising GST Returns

Taxability Provisions and Input Set-off in GST

1. Reverse Charge & Forward Charge 2. Casual Taxable Person 3. Order to Set off...

Payment Process at MCA / ROC Portal

1. Various payment methods 2. Which banks are allowed 3. Which Debit / Credit card...

Composition Scheme in GST & Filing of Return in GSTR-4

1. Who is not eligible for composition scheme under GST? 2. What is Composition...

Limited Liability Partnership (LLP) - Concept, Advantages,...

1 What is Concept of ‘limited liability partnership’ (LLP)? 2 What are the advantages...

Q & A related with SPICe e-forms for incorporation of company...

1. How many names can be applied for in SPICe (INC-32) in MCA for incorporation...

OPC - One Person Company. All your questions now have a...

How to Incorporate OPC (One Person Company)? Do we need to inform MCA / ROC about...

What is AGILE e-form required to be submitted with SPIICE...

AGILE form is linked form to be uploaded along with company incorporation SPICe...

Capital Gain Calculation by Experts

Capital Gain Calculation by Experts

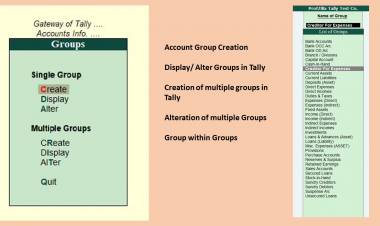

How to Create an Account Group in Tally?

Account groups in Tally, group in tally, multiple account groups in tally, creation...

Download APP

Download APP